Europe’s short selling bans suggest the lessons of 2008 have gone unlearnt

By Ian Fraser

Published: QFINANCE

Date: August 12th, 2011

The temporary short selling bans that have been imposed by Belgium, France, Italy and Spain in the hope of rooting out perceived market abuse and trying to restore a semblance of calm to volatile financial markets have gone down like a lead balloon in the markets.

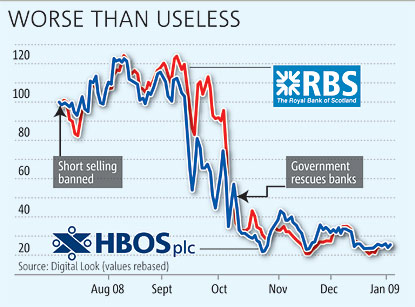

Investors, industry bodies and academics have slammed temporary bans — which apply mainly to securities and other instruments of banks and other financial institutions in four European countries, and were introduced in a move coordinated by the Paris-based European Securities and Markets Authority (ESMA) on August 11 — as counter-productive, citing the failure of similar bans introduced at the height of the major market panic in October 2008.

Hugo Dixon, founder and editor of Reuters Breakingviews, said the reason bank shares have been falling like a stone (and occasionally rebounding) all week is because the eurozone sovereign debt crisis is making it impossible for them to fund themselves satisfactorily. Short selling will have had absolutely no impact on that (and it’s worth remembering that HBOS’s September 2008 collapse owed far more to the fact the bank was effectively bust than to dastardly manoeuvring by “spivs and charlatans of the City”. See this excellent article by Neil Collins from the Evening Standard).

David Buik of BGC Partners was particularly outspoken, castigating the Continentals for their ‘folly’. He said:

“I have heard of a few bone-headed and crass initiatives in my time, but I think Spain’s, Belgium’s, Italy’s and France’s takes the biscuit. Have European politicians learnt nothing from 2008 – the last time a ‘short selling’ ban was implemented? It appears not. Well, just to remind those who are suffering from senile dementia, the effect of the ban was worse than useless. The horse had already bolted in 2008 and it has bolted again this time. Bank values had already collapsed and therefore the ban had no effect at all, apart from stir up an unnecessary degree of uncertainty. Until the EU’s politicians wake up to the fact that there is a stench of fear and uncertainty in the air, much of it down to their ineptness, markets will continue to behave irrationally with seismic levels of volatility.”

The Alternative Investment Management Association (AIMA), which represents the interests of hedge funds, also slammed the temporary bans. In a press release, its chief executive Andrew Baker said:

“Past experience has shown that bans on short selling do not prevent market falls and indeed can exacerbate volatility. Independent academic research also supports this conclusion. Short selling is a legitimate market practice which helps capital markets function effectively. It was only last year that the Committee of European Securities Regulators recognised in an official report that ‘legitimate short selling plays an important role in financial markets. It contributes to efficient price discovery, increases market liquidity, facilitates hedging and other risk management activities and can possibly help mitigate market bubbles.”

The EDHEC Risk Institute argues that highly indebted Continental European governments are using shorting bans as a “smokescreen” to divert investors’ attention away from their own fiscal ineptitude.

In my view, it’s another case of European governments shooting the messenger, rather than actually doing anything worthwhile to address the underlying fragilities at the heart of the euro and of their own flawed financial systems.

This article was first published on QFINANCE on August 12th, 2011

Short URL: https://www.ianfraser.org/?p=4588

It never ceases to amaze me that short selling bans continue to be offered up as a corrective tool in a market that we all know has imploded because of the behaviour of the banks. Surely now has to be to be the right time to fess up and make the necessary changes within these organisations. We should not be expected to buy in to their smoke screen tactics after all that has happened.